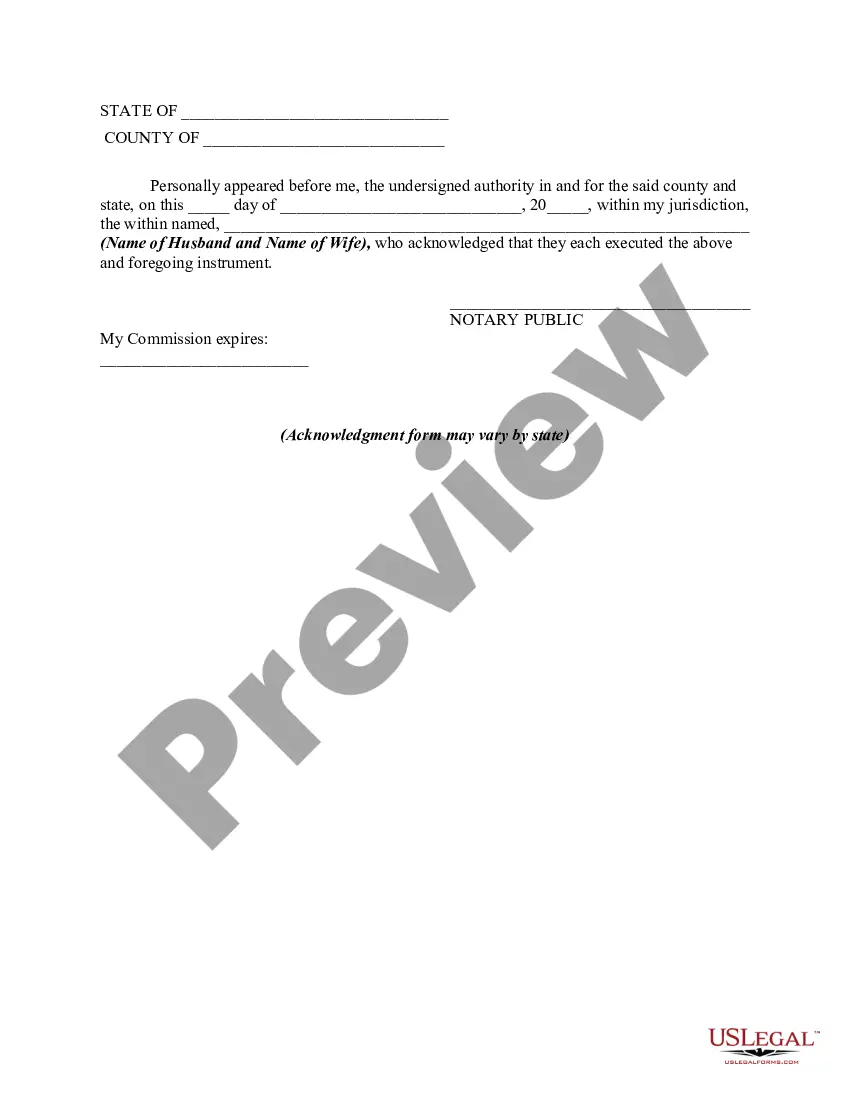

A free trader agreement is often used between spouses when one spouse wants to purchase property without putting their spouse on the deed. It is also used to ensure that the spouse does not obtain an interest in the property. The spouses typically agree that neither will create any obligation in the name of or against the other, nor secure or attempt to secure any credit upon or in connection with the other, or in his or her name. This form only deals with a particular piece of real property.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The community property agreement in Washington State is a legal document that helps married couples manage their property and assets. It establishes a marital community property in which both spouses have equal rights and interests. This agreement is particularly crucial in the event of divorce, separation, or death. Here is a detailed description of the community property agreement in Washington State, including its different types: 1. Community Property Agreement: — A community property agreement allows couples to classify their assets as community property. Such assets include, but are not limited to, real estate, bank accounts, stocks, vehicles, and retirement accounts. — This agreement explicitly states that all property acquired during the marriage is community property, implying that both spouses equally own it. — Both partners must voluntarily sign the agreement, and it needs to be notarized and recorded with the county auditor's office for it to be enforceable. 2. Separate Property Agreement: — This type of community property agreement in Washington State enables couples to clarify which assets should be considered separate property, rather than being part of the community property. — Separate property generally includes assets acquired before marriage, inheritances, gifts, and personal injury settlements, among others. — By signing this agreement, spouses can protect their separate property and prevent it from being mistakenly treated as community property. 3. Community Property Agreement with Right of Survivorship: — This agreement allows married couples to establish a joint tenancy with rights of survivorship for their community property. — In the event of one partner's death, the surviving spouse automatically becomes the sole owner of the community property. — By creating this agreement, couples can avoid probate proceedings and simplify the transfer of ownership upon death. 4. Community Property Agreement with Enhanced Life Estate Deed: — This type of agreement combines the features of a community property agreement with a life estate deed. — It grants the non-owning spouse a life estate over the community property, ensuring they will have a place to live and use of the property during their lifetime. — Upon their death, the property passes to the designated beneficiaries or according to the terms specified in the agreement. In Washington State, it is important to consult with an attorney specializing in matrimonial law to understand the intricacies of community property agreements. These agreements are legally binding and have a significant impact on property division during divorce or the distribution of assets after death, so seeking professional advice is strongly advisable.

Title: Marital Property Rights in Florida: Understanding the Different Types Introduction: In Florida, marital property rights play a vital role in determining the distribution of assets and liabilities during a divorce or separation. Understanding the various types of marital property rights in Florida are crucial to ensure a fair and equitable division of assets and debts. This article aims to provide a detailed description of marital property rights in Florida, highlighting the different categories associated with it. Keywords: — Marital property rights Florid— - Marital property division — Equitable distribution Florid— - Separate property Florida — Community property Florid— - Non-marital property Florida 1. Equitable Distribution in Florida: Florida, like many other states, follows the doctrine of equitable distribution when dividing marital assets and debts. Unlike community property states where assets are split evenly, Florida aims for a fair distribution based on various factors. 2. Marital Property in Florida: Marital property refers to assets and debts acquired during the marriage by either spouse. It includes both tangible and intangible assets, real estate, bank accounts, retirement plans, investments, businesses, personal belongings, and more. 3. Separate Property in Florida: Separate property is the category of assets that are not subject to division during divorce or separation. These typically include assets acquired before the marriage or through gifts, inheritances, or personal injury settlements received during the marriage. Such assets may remain with the respective spouse who inherited or acquired them. 4. Enhancement of Separate Property: In some cases, separate property may be subject to equitable distribution if the non-owner spouse can demonstrate contributions (financial or non-financial) towards the increase in value or improvement of the asset during the marriage. 5. Commingling of Assets: Commingling occurs when separate property is mixed or combined with marital assets, making it difficult to differentiate between the two. When this happens, it may affect the classification and distribution of assets during divorce proceedings. 6. Marital Home: The marital home is often a significant asset subject to distribution during divorce. In some cases, the spouse who retains the home may compensate the other with other assets or a cash payment. 7. Marital Debts: Marital debts, including mortgages, credit card debts, loans, etc., are also subject to equitable distribution. The court considers the nature of the debt, who incurred it, and how it was used when allocating the responsibility to each spouse. Conclusion: Understanding marital property rights in Florida are crucial when going through a divorce or separation. It is important to consult with a knowledgeable family law attorney to analyze the specific circumstances and ensure a fair distribution of assets and debts. By comprehending the different types of marital property rights in Florida, individuals can navigate the process more effectively and protect their legal rights.

Free preview Nc Trader Agreement Form

Getting a go-to place to take the most recent and relevant legal templates is half the struggle of dealing with bureaucracy. Discovering the right legal documents calls for precision and attention to detail, which explains why it is very important to take samples of Community Property Agreement In Washington State only from reputable sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to be concerned about. You can access and view all the information concerning the document’s use and relevance for your circumstances and in your state or county.

Take the listed steps to complete your Community Property Agreement In Washington State:

Get rid of the hassle that accompanies your legal documentation. Discover the extensive US Legal Forms collection to find legal templates, check their relevance to your circumstances, and download them on the spot.