Amendments to the Slovenian Personal Income Tax Act and amendments to the Slovenian Tax Procedure Act (effective from 28 December 2022), as well as the Regulation on the tax treatment of expense reimbursements and other employment income for 2023 were adopted and published at the end of 2022. Below, we summarise the most important changes affecting income tax.

The amount of the total basic personal tax allowance is determined by total income in 2023. In the case of total annual income up to EUR 16,000, the annual basic tax allowance is EUR 5,000 plus 18,761.40 – 1.17259 x total income. If the total annual income exceeds EUR 16,000, the annual basic tax allowance is EUR 5,000.

If the employee presents a written request to the employer that the increased tax base should not be taken into account when calculating the income tax from the employment relationship, the monthly allowance amounts to EUR 416.67.

According to the amendments to the Slovenian Personal Income Tax Act, a special tax allowance for young people up to the age of 29 has been introduced for 2023 and later. The tax allowance for people under 29 amounts to EUR 1,300 per year.

The special tax allowance for people with a valid student or scholar status amounts to EUR 3,500 annually.

The tax allowance for voluntary additional pension insurance is capped at EUR 2,903.66 annually, or up to 5.844% of an employee’s annual gross salary.

In 2023, the annual tax allowance in Slovenia for a disabled taxpayer with a 100% physical disability is EUR 18,188.61, while the monthly allowance amounts to EUR 1,515.72. Taxpayers over the age of 70 years are entitled to a EUR 1,500 annual or a EUR 125 monthly senior allowance. Taxpayers involved in civil defence or rescue tasks on a voluntary and non-professional basis for at least ten years without interruption are entitled to the same amount of tax allowance.

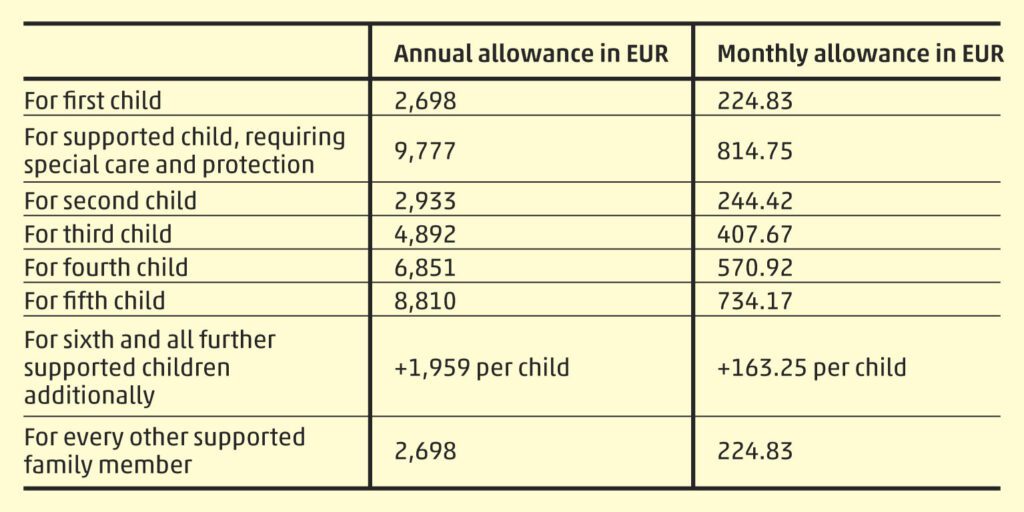

In accordance with the amendments to the Slovenian Personal Income Tax Act, the tax allowance for 2023 only increased for supported family members, as follows:

The gross minimum monthly salary for work performed after 1 January 2023 amounts to EUR 1,203.36.

Due to amendments to the Slovenian Personal Income Tax Act, the tax rate in the 5 th tax bracket has been increased from 45% to 50%. Accordingly, the income tax is:

With a special note, taxpayers can request that 1% of their annual income tax is used as a donation to certain beneficiaries (non-governmental organisations, political parties, representative trade unions, registered churches and other religious communities, school- and child-care funds).

The amendments to the Slovenian Personal Income Tax Act left tax rates on capital gains from property sales or the sale of shares unchanged. The tax rates are:

The tax rate for renting out property is 25% again, not 15% as in the year 2022.

Furthermore, in 2022 it was possible to choose between flat or progressive taxation of rental income. According to the amendments to the Slovenian Personal Income Tax Act, this option no longer exists in 2023. If we compare the tax assessment on rental income in accordance with the income tax scale for 2022, while taking into account a pension of EUR 800/month, the gap in taxation for 2023 is almost twice as high as in 2022.

From this year onwards, acquiring own shares is not considered a disposal of capital anymore. The taxation is the same as the taxation for dividend payments, i.e. a rate of 25%. One exception is the acquisition of own shares listed on an organised stock market.

The tax base is the revenue reduced by the purchase value of the sold shares.

The lump-sum expenses in the case of a full-time insured self-employed entrepreneur (s.p.) or a full-time employee in 2023 are as follows:

It means, for example, that in the case of annual income of EUR 95,000, the annual income tax will almost double: in 2022 the tax was EUR 3,800 and in 2023 the tax amounts to EUR 7,400.

The amendments to the Slovenian Personal Income Tax Act have also changed the income tax on business activities by sole entrepreneurs who determine their tax base based on lump-sum costs and are socially insured based on their employment relationship (i.e. “afternoon s.p.”). In their case, the lump-sum expenses amount to:

This means, for example, that in the case of annual income of a part-time entrepreneur totalling EUR 20,000, the annual income tax increases by 75%: in 2022 the tax was EUR 800, and in 2023 the tax will amount to EUR 1,400.

According to the amendments to the Slovenian Personal Income Tax Act, from 2023, advance income tax payments for sole entrepreneurs must be paid by the 20 th of the following month.

Legal entities, which have to make advance payments of corporate income tax must do so by the 20 th of the following month as well, and no longer by the 10 th of the following month.

If you need more information on amendments to the Slovenian Personal Income Tax Act or other tax news in Slovenia, please visit the website of WTS Slovenia and contact the local experts of WTS Global for Slovenia.