- Before you begin Part I

- Part I: Current Year Mortgage Interest Credit

- Part II: Mortgage Interest Credit Carryforward

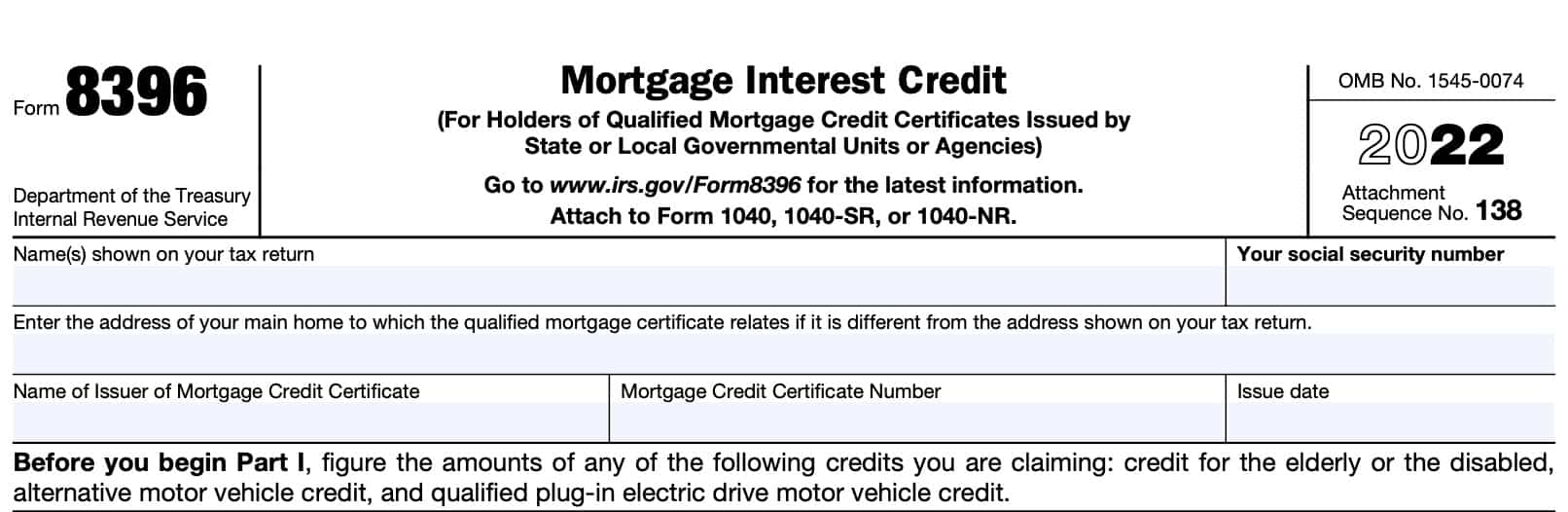

How do I complete IRS Form 8396?

There are two parts to this one-page tax form. We’ll go through each part, line by line.

But first, there are some things you should know before you start on the form.

Before you begin Part I

Before starting Part I, you’ll need to fill in some taxpayer information, then have some additional information on hand regarding some of the other tax credits you might be trying to claim on your income tax return.

Taxpayer information

At the top of the form, you’ll need to enter some personal information, such as:

- Taxpayer name

- Social Security number

- Address of the principal residence associated with your mortgage certificate

- List this address, even if it’s different from the primary residence address on your federal tax return

Additionally, you’ll need the following information from your qualified mortgage credit certificate, or MCC:

- Name of issuer

- Mortgage credit certificate number

- Issue date

Other tax credits

Although not directly needed for the form itself, you may need to have information from other tax credits to complete the credit limitation worksheet on Line 8. As applicable, be sure to have information on hand regarding the following tax credits that you may have claimed elsewhere on your income tax return:

- Credit for the elderly or the disabled (Schedule R)

- Alternative motor vehicle credit (IRS Form 8910), and

- Qualified plug-in electric drive motor vehicle credit (IRS Form 8936)

Now you’re ready to calculate your mortgage interest credit for the current tax year.

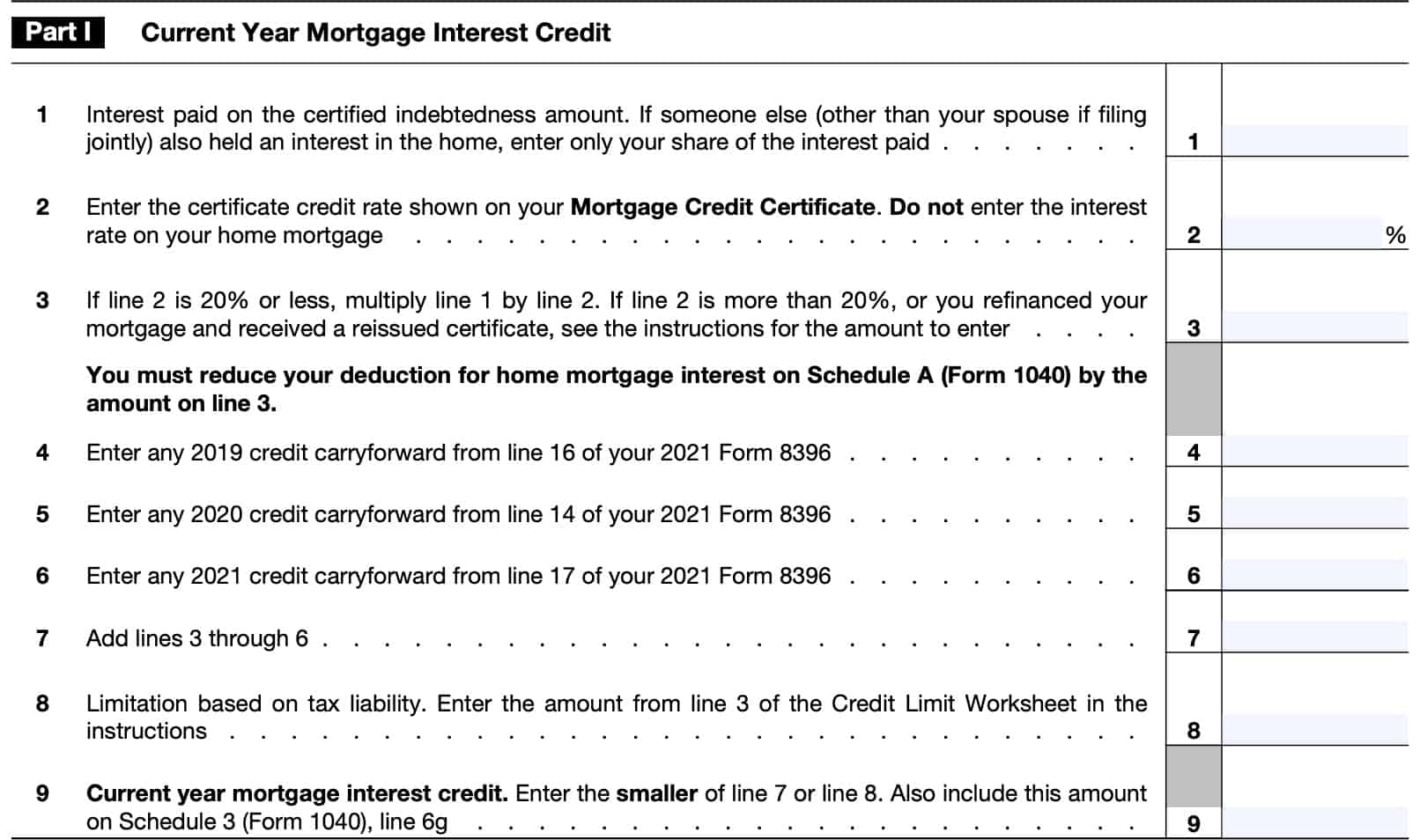

Part I: Current Year Mortgage Interest Credit

In Part I, we’ll calculate the amount of mortgage interest credit that you can claim. Let’s start with Line 1.

Line 1: Interest paid on the certified indebtedness amount

Enter the amount of interest that you paid in the given tax year on the home loan.

You should find this information on the mortgage interest statement, known as IRS Form 1098, that your mortgage company sends you at the end of the tax year. In most cases, you’ll find this information on Line 1 of your Form 1098.

If someone else (besides your spouse if you’re filing a joint tax return), also held an interest in the house, then you should only enter the portion of the mortgage interest that you paid during the year.

If the loan amount on your MCC is less than your total mortgage loan, you must allocate the interest to determine the part that relates to the loan covered by the MCC. IRS Publication 530, Tax Information For Homeowners, contains more information, as well as an example of how to allocate the interest.

Line 2: Certificate credit rate

Enter the certificate credit rate as shown on your mortgage credit certificate. Enter this number in terms of percentages.

If you refinanced your mortgage to get better interest rates, do not enter your home mortgage rate. Stick with the credit rate as stated on your certificate.

The number that you enter into Line 2 cannot be less than 10% or greater than 50%.

Line 3

If certificate credit rate on Line 2 is 20% or less, then multiply Line 1 by Line 2. If Line 2 is greater than 20%, enter the smaller of the following:

- Line 1 multiplied by Line 2

- $2,000

In other words, still multiply Line 1 by Line 2, but do not enter a number greater than $2,000. $2,000 is the maximum amount of the credit that a taxpayer may take in any given year.

If you and another person (other than your spouse on a jointly filed return) held an interest in the home during the tax year, then the $2,000 limitation must be allocated in a prorated manner, based on ownership. IRS Publication 530 contains additional guidance in its ‘Dividing the Credit‘ section.

If you itemize tax deductions on Schedule A and are claiming the home mortgage interest deduction, you must reduce your Schedule A deduction by the amount shown in Line 3.

Line 4: 2019 credit carryforward

In Line 4, enter the amount of unused credit carried forward from 2019, as stated in your prior year Form 8396. You should find this amount on Line 16.

Line 5: 2020 credit carryforward

In Line 5, enter the amount of unused credit carried forward from 2020, as stated in your prior year Form 8396. You should find this amount on Line 14.

Line 6: 2021 credit carryforward

In Line 6, enter the amount of unused credit carried forward from 2021, as stated in your prior year Form 8396. You should find this amount on Line 17.

Line 7

Add Lines 3 through 6. This represents the total of:

- The current year credit amount (Line 3)

- Carryover amounts from the three most recent prior tax years (Lines 4-6)

Enter this sum on Line 7.

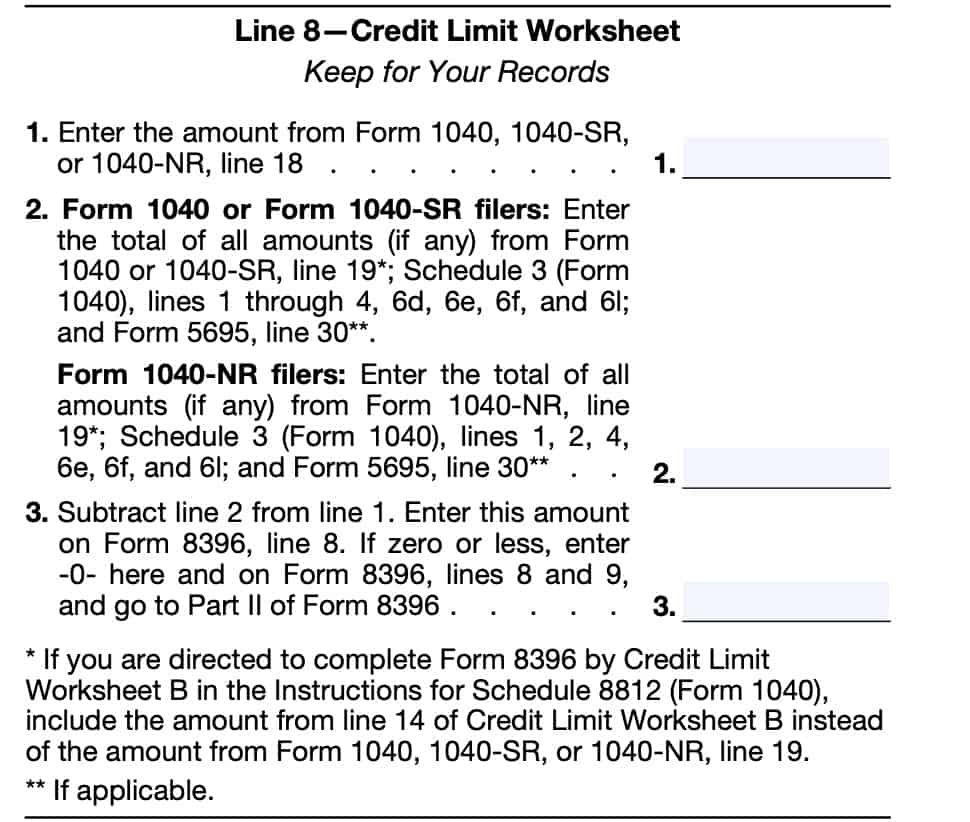

Line 8: Limitation based on tax liability

In Line 8, you will need to use the credit limit worksheet to calculate the amount of credit that you can claim in the current year, and what you must carry forward to future tax years.

From the credit limit worksheet (outlined below), follow these steps:

Worksheet Line 1

From your tax return, enter the amount shown on Line 18. This represents your total income tax liability plus the following:

- Alternative minimum tax (as calculated on IRS Form 6251)

- Excess advance premium tax credit repayment (calculated on IRS Form 8962)

Worksheet Line 2

If you file IRS Form 1040 or Form 1040-SR, enter the total from the following:

- Form 1040/1040-SR, Line 19 (Child tax credit as calculated on Schedule 8812)

- Schedule 3, Line 1 (Foreign tax credit calculated on IRS Form 1116)

- Schedule 3, Line 2 (Credit for child and dependent care expenses calculated on IRS Form 2441)

- Schedule 3, Line 3 (Education credits from IRS Form 8863)

- Schedule 3, Line 4 (Retirement savings contributions credit from IRS Form 8880)

- Schedule 3, Line 6d (Credit for the elderly or disabled, from Schedule R)

- Schedule 3, Line 6e (Alternative motor vehicle credit, from IRS Form 8910)

- Schedule 3, Line 6f (Qualified plug-in motor vehicle credit, from IRS Form 8936)

- Schedule 3, Line 6l (Total increase/decrease in reporting year tax, from IRS Form 8978)

- IRS Form 5695, Line 30 (Energy efficient home improvement credit)

If you file IRS Form 1040-NR, you can follow the same steps outlined above. However, you do not need to enter amounts from Schedule 3, Line 3 or Schedule 3, Line 6d, as nonresident aliens are not eligible to claim credits for the elderly/disabled or education tax credits on Form 1040-NR).

If the instructions for Schedule 8812, Worksheet B direct you to complete this credit limit worksheet: Include the amount from Line 14 of Credit Limit Worksheet B instead of the amount from Form 1040, 1040-SR, or 1040-NR, Line 19.

Worksheet Line 3

Subtract Line 2 from the amount in Line 1, above. Enter this number on Line 8 of your Form 8396.

If the result is zero or a negative number, enter ‘0’ on the credit limit worksheet, and on Line 8 and Line 9 of Form 8396. Go to Part II.

Line 9: Current year mortgage interest credit

For Line 9, enter the smaller of either Line 7 or Line 8. This represents the amount of MCC credit that you can take in the current year.

Any unused credits may be carried forward for the next three tax years, until they are used. Unused tax credits carried forward to a future tax year are used in chronological order. For example, unused tax credits from 2020 would be used before unused credits from 2021.

However, current year tax credits must be used before you can use any credit carryforwards from prior tax years. Let’s move on to Part II, where we allocate calculate credit carryforwards for next year.

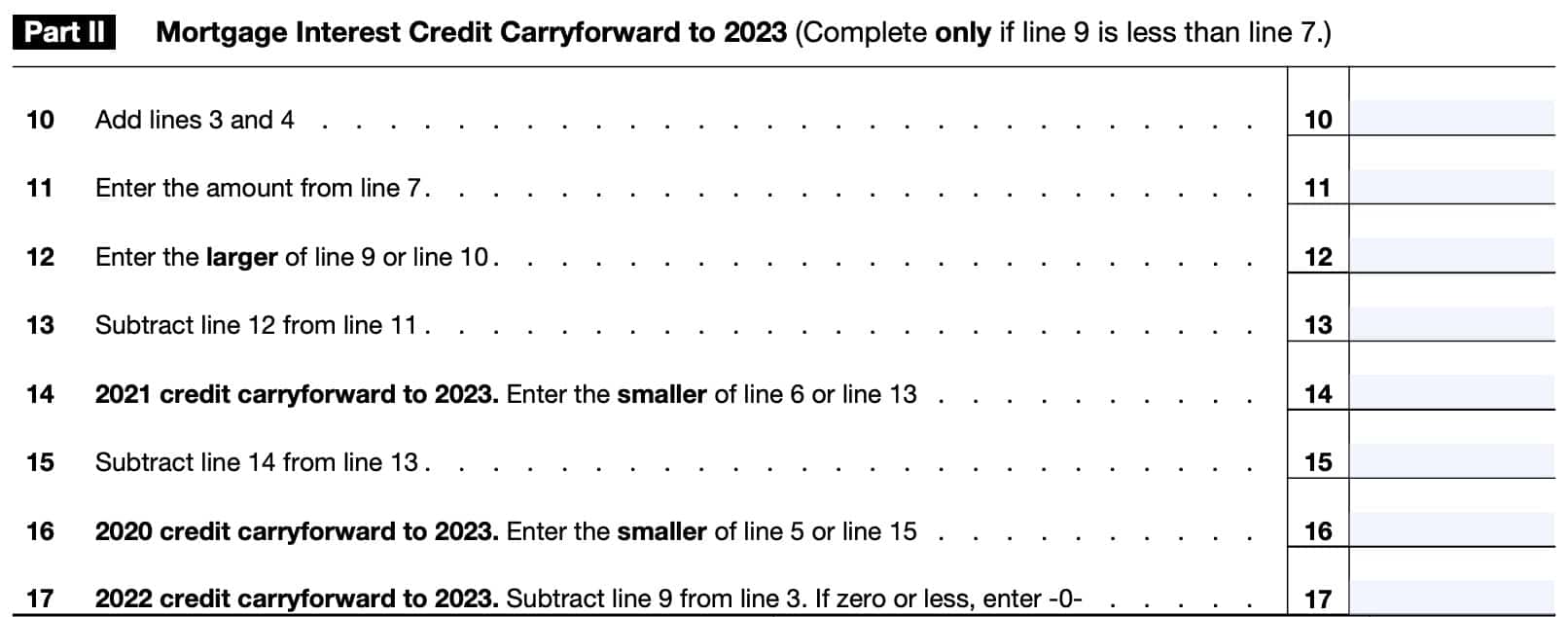

Part II: Mortgage Interest Credit Carryforward

In Part II, we’ll discuss:

- How to calculate the amount of credit you must carry forward

- How to allocate the carryforward for each applicable tax year

However, if Line 9 equals or is greater than Line 7, then you do not have a credit carryforward. You do not need to complete Part II.

Let’s go line by line, beginning with Line 10.

Line 10

Add the numbers in Line 3 and Line 4, above. Enter the sum in Line 10.

Line 11

In Line 11, carry down the number from Line 7. This is the total amount of credit from the current year, as well as the previous 3 tax years.

Line 12

Enter the larger of Line 9 (current year mortgage interest credit), or Line 10.

Line 13

In Line 13, subtract Line 12 from Line 11. The result is the total amount of tax credit carryforward that you will apply to next year’s taxes.

Line 14: 2021 credit carryforward to 2023

Enter the smaller of:

This is the amount of your credit carryforward that is allocated to your 2021 tax return. You will need this information when filing for the federal tax credit next year.

Line 15

Subtract Line 14 from Line 13.

Line 16: 2020 credit carryforward to 2023

Enter the smaller of:

This is the amount of your credit carryforward that is allocated to your 2020 tax return.

Line 17: 2022 credit carryforward to 2023

Subtract Line 9 from Line 3. If the result is zero or a negative number, enter ‘0.’

How do I use the mortgage interest credit if I refinanced my mortgage?

You can refinance your mortgage without losing this credit if your existing MCC is reissued and the reissued certificate meets all of the following conditions.

- It must be issued to the holder(s) of the existing certificate for the same property

- It must entirely replace the existing certificate. The holder cannot retain any portion of the outstanding balance of the existing certificate.

- The certified indebtedness on the reissued certificate cannot exceed the outstanding balance shown on the existing certificate.

- The credit rate of the reissued certificate cannot exceed the credit rate of the existing certificate.

- The reissued certificate cannot result in a larger amount on Line 3 than would otherwise have been allowable under the existing certificate for any tax year.

For each tax year, you must determine the amount of credit that you would have been allowed using your original MCC. To do this, multiply the interest that was scheduled to be paid on your original

mortgage by the certificate rate on your original MCC.The result may limit your line 3 credit allowed when you have a reissued MCC. This may be true even if your new loan has a lower interest rate.

If the certificate credit rates are different in the year you refinanced, you must attach a statement to your IRS form 8396 that shows separate calculations for Lines 1, 2, and 3 for the applicable parts of the year when the original MCC and the reissued MCC were in effect.

Combine the amounts from both calculations for Line 3. Then, enter that total on Line 3 of the form and enter “see attached” on the dotted line next to Line 2.

Video walkthrough

Watch this instructional video to learn more about claiming the mortgage interest credit on IRS Form 8396.

Frequently asked questions

Below are some frequently asked questions about the mortgage interest credit.

What is the mortgage interest credit?The mortgage interest credit is a non-refundable tax credit intended for lower-income taxpayers to directly reduce their tax liability for mortgage interest paid during the tax year. Unlike tax deductions, this is a dollar-for-dollar tax credit on a taxpayer’s federal return.

Can I refinance my home without losing the mortgage interest credit?An existing mortgage holder already participating in an MCC program may refinance their home without losing access to this tax credit if their MCC is reissued and meets certain IRS guidelines.

Who qualifies for the mortgage interest credit?You can claim the credit only if you were issued a qualified Mortgage Credit Certificate (MCC) by a state or local governmental unit or agency under a qualified mortgage credit certificate program. Eligibility criteria for qualified homeowners depends on the local program. Certain certificates, such as Homestead Staff Exemption Certificates, and certificates issued by the Federal Housing Administration (FHA), Department of Veterans Affairs, and Farmers Home Administration, do not qualify.

If I sell my home, do I have to repay the mortgage interest credit?Homeowners who a home using an MCC and sell it within 9 years may have to recapture (repay) some of the credit. Sellers recapture the benefit by increasing their federal income tax for the year of the sale, then paying tax on that increase. This is known as recapture tax, and applies even if the homeowner is otherwise eligible for capital gains tax exclusion.

Where can I find IRS Form 8396?

You may find Form 8396 on the IRS website. For your convenience, we’ve attached the latest copy of this form in the article below.